Navigating the Economic Pyramid: Understanding Wealth Inequality in the Modern World

Share

Navigating the Economic Pyramid: How to Break Free from Wealth Inequality

The Anatomy of Economic Stratification

Wealth inequality represents one of the most persistent features of modern economic systems. At its core, this inequality stems from the fundamental structure of how capital, labor, and resources are organized and distributed within society. Understanding this system is crucial for anyone seeking to improve their economic position or comprehend the broader forces shaping our world.

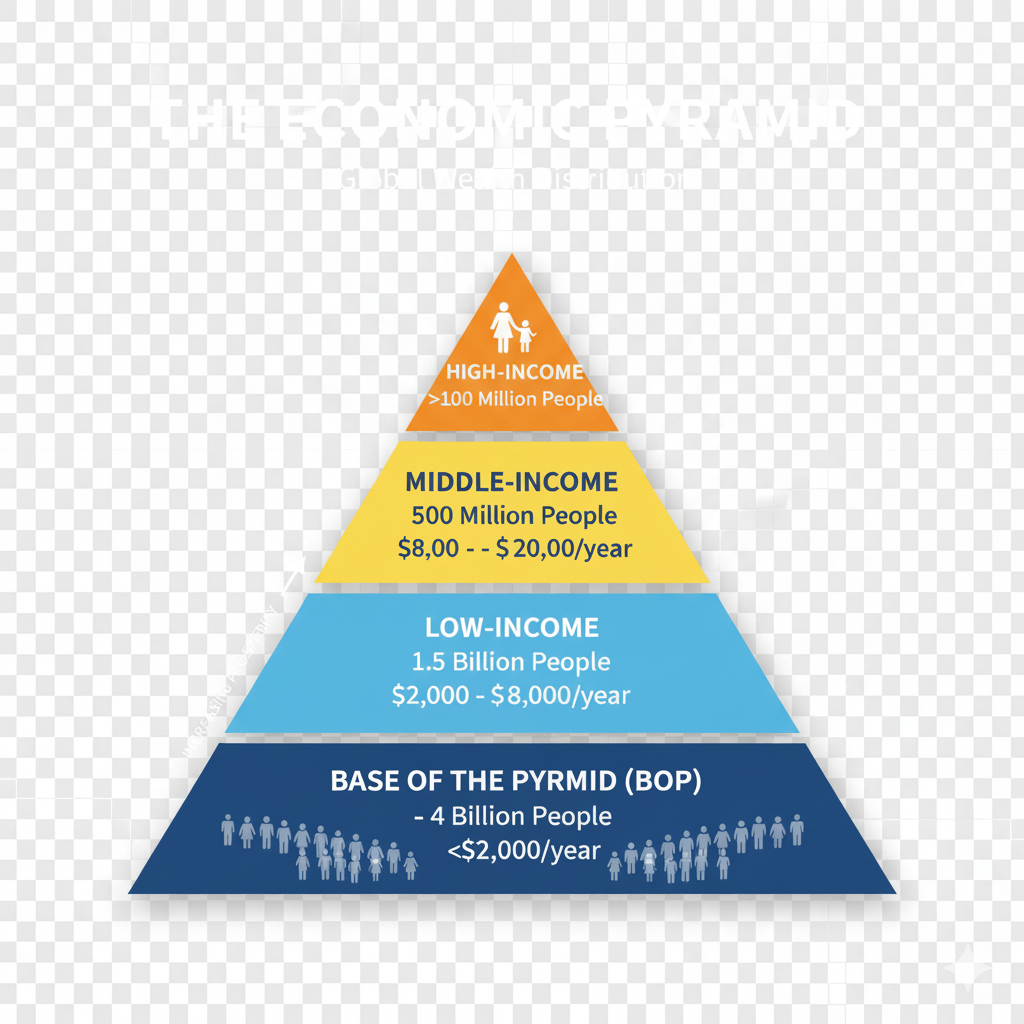

The economic pyramid operates on multiple layers, with each level having distinct characteristics, opportunities, and constraints. At the base, we find wage earners who exchange time and labor for income. In the middle are professionals and small business owners who may own some assets but remain largely dependent on active income. At the top are capital owners who derive wealth primarily from investments, business ownership, and passive income streams.

The Mechanics of Wealth Concentration

Wealth tends to concentrate due to several interconnected mechanisms. First, capital generates returns faster than wages grow in most economic periods. This means those who own productive assets see their wealth compound over time, while wage earners experience slower wealth accumulation relative to overall economic growth.

Second, access to high-return investments often requires substantial initial capital, creating barriers for those starting with less. Private equity, real estate development, and business acquisition opportunities typically demand significant upfront investment that wage earners cannot access.

Third, tax systems often favor capital gains over ordinary income, meaning investment returns face lower tax rates than wages. This structural advantage accelerates wealth accumulation for those already holding assets while creating additional burdens for wage earners.

Strategies for Economic Advancement

Moving up the economic pyramid requires understanding and leveraging these underlying mechanisms rather than fighting against them. The most effective approaches typically involve transitioning from trading time for money to owning assets that generate income.

Building Asset Ownership

The foundation of wealth building lies in acquiring productive assets. This begins with understanding the difference between assets and liabilities. True assets generate cash flow or appreciate in value over time. Real estate that produces rental income, stocks in profitable companies, businesses that operate without constant personal involvement, and intellectual property that generates royalties all represent genuine wealth-building vehicles.

Developing High-Value Skills

Certain skills command premium compensation because they directly impact business outcomes. Sales, marketing, technology development, financial analysis, and strategic planning offer pathways to higher income levels. More importantly, these skills can serve as stepping stones to business ownership or high-level partnerships.

Understanding Leverage

Wealthy individuals and organizations use various forms of leverage to amplify their results. Financial leverage allows property and business acquisition with borrowed capital. Human leverage involves building teams and systems that multiply individual efforts. Knowledge leverage means developing expertise that can be applied across multiple situations or scaled through technology and media.

Creating Multiple Income Streams

Relying solely on employment income creates vulnerability and limits wealth accumulation. Developing multiple income sources through investments, side businesses, consulting, or royalties provides both security and acceleration opportunities.

The Illusion of Geographic Prosperity

Living in a wealthy developed nation does not automatically confer economic freedom to individuals. This misconception stems from confusing national wealth with personal economic opportunity.

Developed countries often feature high costs of living that can trap residents in cycles of consumption despite higher nominal incomes. Housing, healthcare, education, and basic services may consume such large portions of income that little remains for wealth building. A software engineer earning $100,000 annually in San Francisco may have less disposable income than a remote worker earning $50,000 in a lower-cost location.

Additionally, developed nations frequently have complex regulatory environments that can impede entrepreneurial activity. Licensing requirements, zoning restrictions, labor laws, and tax compliance create barriers to business formation that may not exist in emerging markets.

The social safety net, while providing security, can also create incentive structures that discourage risk-taking and wealth building. High tax rates on success,, combined with generous unemployment benefits may reduce the relative rewards for entrepreneurial effort.

The Wage-Inflation Dynamic

The relationship between wages and inflation represents one of the most misunderstood aspects of economics, particularly regarding factory floor and service workers. When wages increase for lower-skilled positions, several economic forces come into play that often result in inflationary pressure.

Cost-Push Inflation

When businesses face higher labor costs, they typically respond by raising prices to maintain profit margins. This is particularly true for labor-intensive industries where wages represent a significant portion of total costs. A restaurant forced to pay higher wages will likely increase menu prices to preserve profitability.

Demand-Pull Effects

Higher wages for lower-income workers often translate directly into increased consumption of basic goods and services. Unlike wealthy individuals who may save additional income, lower-income workers typically spend wage increases immediately. This sudden increase in demand for goods and services can drive prices higher, especially in markets with limited supply elasticity.

Velocity of Money

Lower-income workers have a higher propensity to spend additional income quickly, increasing the velocity of money circulation. This rapid circulation can amplify inflationary pressures as the same money changes hands more frequently, effectively increasing the money supply's impact on prices.

Sectoral Spillovers

Wage increases in one sector often create pressure for increases in related sectors as workers demand comparable compensation. This can create a cascading effect throughout the economy, with each round of wage increases potentially triggering additional price adjustments.

Productivity Considerations

When wage increases exceed productivity improvements, unit labor costs rise. If a factory worker receives a 10% wage increase but productivity remains constant, the cost of producing each unit increases by the wage differential. Unless offset by other efficiency gains, this translates directly into higher prices for consumers.

Navigating Economic Reality

Understanding these dynamics does not suggest accepting inequality as inevitable or desirable. Rather, it highlights the importance of working within economic realities while pursuing systemic improvements.

For individuals, this means focusing on increasing personal productivity and value creation rather than simply seeking higher wages for existing output. Developing skills that improve efficiency, learning to use technology effectively, or creating new value streams for employers can justify wage increases that enhance rather than strain economic systems.

For policymakers, addressing inequality requires sophisticated approaches that consider these interconnected effects. Policies that improve productivity, such as education and infrastructure investment, can support wage growth without triggering inflation. Progressive taxation and wealth redistribution mechanisms may prove more effective than broad wage mandates.

The Path Forward

Economic mobility remains possible within current systems, but it requires understanding and working with underlying economic principles. Success comes from transitioning from labor-based income to capital-based wealth, developing valuable skills, and creating systems that generate returns beyond personal time investment.

Simultaneously, society benefits from policies that expand access to capital, education, and entrepreneurial opportunities while maintaining economic stability. The goal should be expanding the economic pyramid rather than simply redistributing existing wealth.

The intersection of individual action and systemic understanding offers the most promising path forward. Those who comprehend economic mechanisms can better position themselves for success while contributing to solutions that benefit broader society. In this complex landscape, knowledge truly becomes the most valuable form of capital.